In private equity fund of funds, investors commit to a fund, which in turn makes commitments to a predetermined number of underlying funds. Investors achieve diversification through exposure to a high number of funds, and in turn a high number of companies, with just one commitment. This article seeks to analyze the performance of fund of funds, their strengths and weaknesses, and the types of investors they make sense for.

There are several reasons why investors utilize fund of funds to obtain private equity exposure. The graph below shows the most cited reasons for investing in a private equity fund of funds.

Motivations for Investors Utilizing PE Fund of Funds

Exhibit A. Source: Preqin Special Report: Private Equity Funds of Funds, March 2014. Participants had the ability to select multiple response.

Through a fund of funds, the burden of manager selection and commitment pacing falls on the fund manager.

While they help create diversification in a convenient way for investors, there are some notable downsides to fund of funds.

The May 2017 study “Financial Intermediation in Private Equity: How Well do Fund of Funds Perform?” by Robert S. Harris, Tim Jenkinson, Steven N. Kaplan, and Ruediger Stucke found that of funds raised in a 20-year period between 1987 and 2007 (performance as of year-end 2012), showed that there is "significantly lower returns for fund of funds that focus on buyouts or are generalist funds compared with portfolios formed by ‘random’ direct fund investing.”

An analysis of PitchBook data indicated that median returns for direct buyout funds have been consistently higher than for fund of funds. Although the gap has closed somewhat for recent vintage years, this is in part due to the earlier stage of the funds. A more significant difference is noticed when analyzing the threshold for first quartile funds, as fund of funds display less upside as a result of high diversification and a double layer of carried interest capping returns. The fourth quartile threshold has been higher for fund of funds in recent vintage years due to downside protection from diversification.

Exhibit B. Source: PitchBook data as of December 4, 2019 showing most recent reporting quarter with IRR.

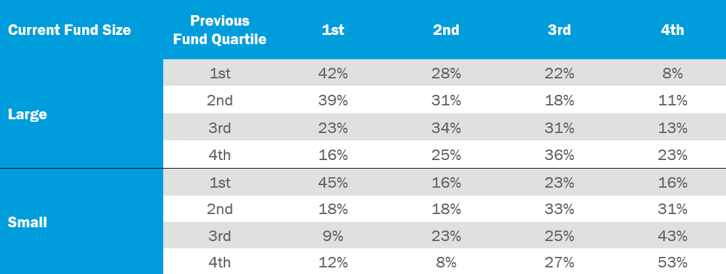

According to the study mentioned earlier by Harris, Jenkinson, Kaplan, and Stucke, the persistence of returns among venture managers is much higher than their buyout counterparts. A fund raised by a manager whose previous fund was in the first quartile had a 48.1% chance to repeat as first quartile again. Similar findings were reported by Adams Street Partners’ “The Persistence of PE Performance” in 2017, as depicted in the table below, which shows that first quartile venture funds between 1979 and 2010 had a 43% chance of repeating in the top quartile.

Exhibit C. Source: Adams Street Partners, "The Persistence of PE Performance."

Does this mean investors should just make direct commitments to venture funds that were previously top quartile? This is often not possible, as consistently top-performing venture funds tend to be oversubscribed and not available to new investors. From a performance standpoint, as concluded by Harris, Jenkinson, Kaplan, and Stucke, “in contrast [to buyout-focused or generalist fund of funds], fund of funds in venture capital perform roughly on par with portfolios of direct funds, even after the additional fees… Venture capital fund of funds create more risk reduction through diversification than is the case for buyouts. In general, our results suggest that fund of funds focusing on venture capital provide more advantages than those investing in buyout funds."

The data and studies discussed show that for a sophisticated investor, a buyout portfolio of direct commitments has consistently outperformed buyout or generalist fund of funds. Contrarily, venture capital fund of funds have performed on par with portfolios of direct venture funds with increased diversification and lower risk. Therefore, Canterbury recommends that most clients gain buyout exposure directly and venture capital exposure through fund of funds.

This is, of course, subject to exceptions. For example, Harris, Jenkinson, Kaplan, and Stucke’s study showed that while generating lower returns than direct buyout portfolios, fund of funds have still historically outperformed the public markets. Fund of funds are therefore a fit for investors that have neither an advisor nor the capacity or bandwidth to construct a direct portfolio of high conviction buyout funds. Additionally, an investor with the ability to gain access to top tier and difficult-to-access venture managers could consider a direct portfolio in that space.