The price of risk assets continued to grind higher during the first quarter amidst positive economic data. Strong GDP growth and moderating inflation have created a "goldilocks" set of conditions that have boosted consumer confidence and spending on goods and services. Capital markets have continued their upward trend since November 2023. It seems that what has mattered more is not the timing and magnitude of Central bank rate cuts but simply the Federal Reserve's affirmation that no further hiking was needed.

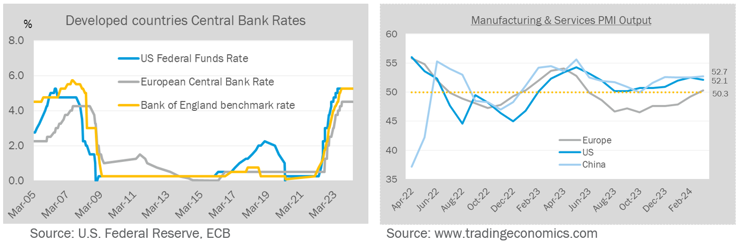

In January, the U.S. Commerce Department's Bureau of Economic Analysis reported that real GDP increased 3.1% in 2023 compared to 0.7% in 2022. At the same time, inflation has moderated to 2.5% in the most recent period. GDP growth in Europe was lower at under 1%, while inflation has been more "sticky" at over 3%. Nonetheless, manufacturing and servicing output has improved since a year ago and inched up over 50 across most economic regions, indicating expansion in economic activity, even amidst higher borrowing rates. Wage growth has been modest, possibly because corporations are finding ways to deploy technology and artificial intelligence tools to improve productivity and corporate margins

We cannot predict the probability or timing of the next economic slowdown, nor can we opine on the need to reduce rates from current levels. At this time, though, the broadening of positive fundamentals supports higher valuations amidst markets anticipating further easing monetary conditions from here. Analysts forecast S&P 500 earnings to grow a healthy 11% in 2024 and possibly another 13% in 2025. Barring some significant circumstances, the European central banks have managed their short-term borrowing rates in lockstep with the U.S. Federal Funds Rate over the years and will likely cut in line with the Federal Reserve.

Access the Canterbury Outsourced CIO: First Quarter 2024 Commentary