Private equity managers have increasingly been utilizing subscription lines of credit to manage capital calls from limited partners. This results in a delay of capital called from investors, which increases the fund’s internal rate of return (IRR) while lowering the multiple of invested capital (MOIC) due to interest paid on the credit line. This post seeks to explain the mechanics and impact of subscription lines as well as some of the merits and considerations of their utilization.

Subscription lines are loans taken out by private equity funds that must be repaid over a defined period of time. These lines are backed by limited partners’ committed capital to the fund and generally have an interest rate of between 3% and 6% depending on the size of the line, time of repayment, and the limited partners invested in the fund.

Subscription lines are not a new phenomenon in private equity; in fact, their utilization dates back decades. At the start and for many years after, they allowed managers to make life easier for both themselves and limited partners by borrowing to fund bridge financings and then immediately calling the capital from limited partners, thus repaying the line in 30 days or less.

As time has gone by and in part driven by a low interest rate environment, the prevalence of subscription lines, their size, and the time to repay them has been increasing rapidly. Private equity funds now regularly utilize a facility that represents a significant percentage of limited partner commitments and are only required to repay them every 90, 180, or even 360 days — and the terms are only getting more aggressive over time.

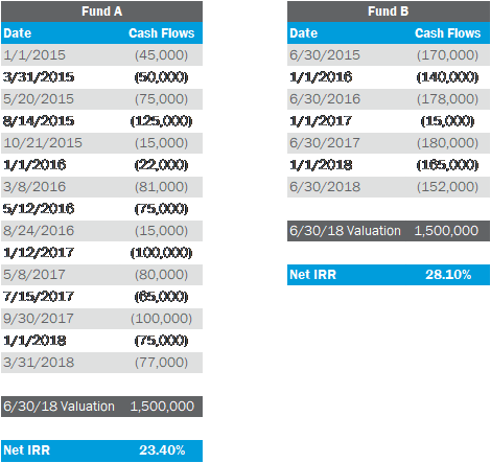

The following example shows a performance comparison between two funds that invested $1 million over an investment period of just over three years. Both funds make the exact same investments at the same time, but Fund A calls capital whenever investments are made or fees/expenses are incurred, while Fund B has a subscription line that is paid off every six months.

IRR is the main measurement of performance for private equity funds, which is based on inflows to and outflows from the investor, as well as the time period in which these inflows and outflows occurred. As shown by the comparison in exhibit A, the impact on the IRR is substantial after three years with a spread of 470 bps, or 4.7%. Please note that negative numbers indicate contributions while positive numbers indicate distributions and valuations.

Exhibit A.

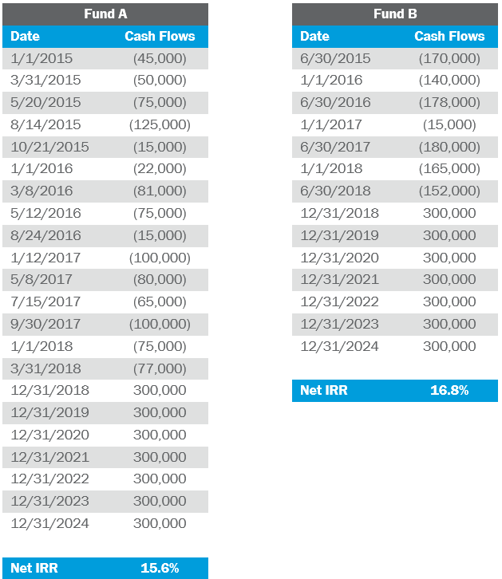

Exhibit B shows the performance of both funds after seven years of distributions. For simplicity’s sake, in this hypothetical example, capital is distributed once per year

Exhibit B.

The utilization of a credit line for capital calls early in the fund’s life still had a small impact 10 years later when the fund was fully liquidated. This example does not account for the interest paid on the line of credit, which would bring the terminal performance even closer together. In conclusion, while subscription lines have a meaningful impact on net IRR in the early stages of a fund, the disparity is dampened substantially in the long run.

1. Less frequent and more predictable cash flows

Some private equity strategies, such as fund-of-funds or secondaries funds, involve making commitments to a large number of underlying funds. As a result, the funds will have frequent capital call obligations, as often as multiple times per week. A subscription line enables these funds to instantly pay their capital calls using the line, then call capital from their limited partners on a predictable basis, generally quarterly or semi-annually.

2. Ability for managers to act quickly on opportunities

At times, funds will come across an opportunity that must be executed quickly. In general, capital calls issued to limited partners require payment within 14 days, so it would therefore be possible that an opportunity is missed due to this constraint. By utilizing a line of credit, the fund can make the investment immediately and call the capital at a later date.

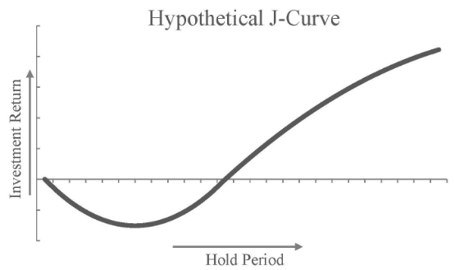

3. J-curve mitigation

The j-curve refers to the performance timeline of private equity funds. Early in a fund’s life, capital is called for investments as well as fees and expenses while the portfolio companies have not yet had the time required to appreciate. As a result, the general trend of performance is as illustrated below:

Exhibit C.

The deferment of early capital calls and stronger early performance mitigates the impact of the j-curve and decreases the amount of time required for a fund to generate positive returns.

1. Impact on carried interest

The higher early IRR from utilizing a credit line can enable a fund to eclipse its preferred return, most commonly 8%, at an earlier stage of its life. This is most impactful for funds that have a deal-by-deal carry structure, meaning that carry is paid on the performance of each deal rather than the overall fund. Canterbury notes that the overall amount of carried interest paid is not impacted substantially by the use of a credit line as full-term performance remains similar and the multiple actually decreases slightly.

2. Higher overall expenses

While the borrowing rate has been lower than historical averages in recent years, interest still must be paid on the borrowed capital from the credit line. This results in a lower multiple of invested capital for funds with subscription lines, as there are no additional profits in dollar terms to offset this interest.

3. Potential UBTI Generation

Unrelated Business Taxable Income (UBTI) can be incurred through the use of a credit line. This is particularly meaningful to tax-exempt investors who are required to pay taxes on UBTI, which is inclusive of income derived from assets subject to “acquisition indebtedness.” While firms have the ability to mitigate this through the use of blocker structures or other means, the likelihood of UBTI generation remains higher with the utilization of a subscription line.