In his book, The World is Flat, Tom Friedman explores how the globalization of trade and the resulting flattening of the world. He felt that they contribute to the emergence of middle-class jobs in developing countries while simultaneously reinforcing the regional identities of developed nations. By applying the principle of comparative advantage, less desirable jobs—such as the manufacturing of plastic buckets and T-shirts—are outsourced to countries with cheaper labor. Meanwhile, intellectual property and advanced technologies are retained in developed nations, allowing them to continue benefiting from ongoing research and development efforts.

What initially appeared to be an altruistic and economically egalitarian approach in the 1990s may now seem somewhat naive, given the complexities of today's global landscape. The negotiated sharing of information and intellectual property, strategic government support for specific industries through tariffs and subsidies, and the influence of less democratically elected political regimes have reshaped the competitive order by the 2020s. Today, nations like China can compete directly with the U.S. and Europe in cutting-edge technologies, next-generation automobiles, and semiconductor manufacturing equipment.

Another significant aspect of global trade is the prolonged period of uneven trade balances, during which the U.S. has accumulated large trade deficits, fueled by increasing levels of debt and a substantial strengthening of the U.S. dollar. This situation has been partly sustained by the substantial purchases of U.S. Treasuries by its largest trading partners. It's important to note that a variety of factors—including recessions, pandemics, and persistent deficit spending—have contributed to the swelling of the national debt. However, this accumulation has also heightened the country’s vulnerability to rising interest rates.

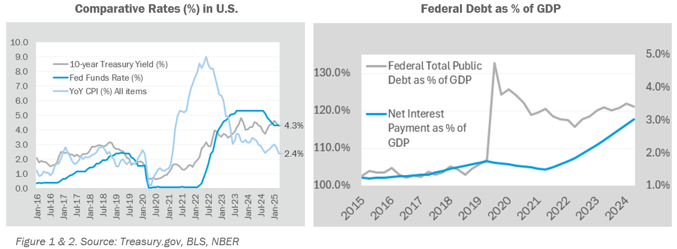

With Federal Reserve Chairman Powell expressing optimism that inflation is nearing the 2% target by late 2024, the Federal Open Market Committee (FOMC) initiated a reduction in the Federal Funds rate from 5.25% to 4.25%. Despite this, the Bureau of Labor Statistics reports that consumers still perceive inflation as persistent. This perception may stem from the lagging effect of tapering rent increases as the supply of new apartments gradually catches up to the construction declines caused by the pandemic, or from the lingering impact of already elevated prices.

More critically, federal debt levels, which exceeded 100% of GDP during the pandemic, have yet to return to pre-2020 levels, with an increasing share of the budget allocated to net interest payments due to recent borrowings at higher rates. Given the current strength of the economy, it’s difficult to dispute Powell’s assertion that “the Fed does not need to be in a hurry” to implement further rate cuts. Additionally, the uncertainty surrounding tariffs—ranging from 10% to over 100%—has added complexity to the inflation outlook and the overall economy, compelling the Fed to adopt a cautious “wait and see” approach.

The “uncertainty” stemming from tariff announcements can be quite “sticky,” potentially triggering a domino effect if it continues. Anticipation of price increases due to higher tariffs can dampen consumer sentiment and negatively affect spending at all levels. There is considerable speculation that much of this tariff rhetoric is a strategic maneuver to push trading partners towards negotiating better terms. However, uncertainty surrounding the potential outcomes of these negotiations—and their impact on various industries and consumers—remains pervasive. In the short term, companies are likely to scale back on spending and bolster their reserves as they assess the implications for their supply chains. A collective shift among businesses and consumers to curtail spending can lead to a slowdown in economic activity, which, if combined with rising unemployment, could escalate into a recession.

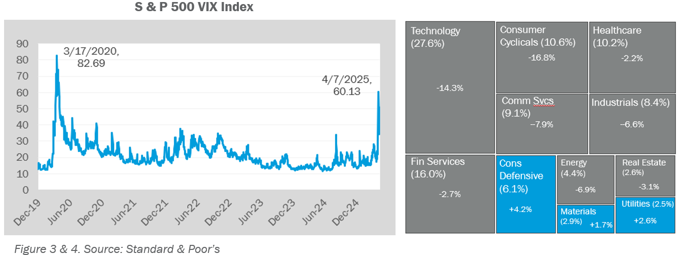

In the early weeks of April, the markets were unsettled by the ongoing turmoil surrounding tariff announcements from the U.S. and its trading partners. Equity markets experienced daily fluctuations exceeding 2%, reflecting heightened uncertainty. Notably, the VIX index, widely recognized as a gauge of volatility in the U.S. equity markets, surged past 60, marking its highest level since March 2020.

The selloff in stocks affected nearly all sectors, with technology and industrials experiencing the most significant declines due to their heightened dependence on global supply and customer chains. Equity markets typically aim to anticipate potential future outcomes, which in this case may include concerns over an economic slowdown—not just from waning economic activity but also potentially stemming from headlines about possible government cutbacks. Year-to-date returns reflect the first quarter's downturn for U.S. equities, with only defensive sectors, such as utilities and those offering dividends, showing any positive gains. As volatility in the equity markets subsided after the initial two weeks of April, it suggests that while uncertainty remains, the markets may not be bracing for a full-blown recession.

Small companies faced greater challenges than their larger-cap counterparts during this market downturn. These smaller firms often lack the diversified business models of larger corporations, making their earnings more cyclical and susceptible to economic shifts. In an environment characterized by prolonged higher interest rates amidst slowing economic activity, these companies face an increased risk of being unable to withstand price shocks, especially over an extended period.

During periods of equity volatility, capital typically shifts towards "safe haven" investments, such as U.S. Treasuries and the U.S. Dollar. However, this trend did not materialize in the current situation, as concerns about the longer-term impacts of elevated tariffs, rising inflation, and increased interest burdens on federal debt loomed large. Additionally, there were apprehensions that some of the major holders of Treasuries, particularly those in countries that have historically been large exporters to the U.S.—like China—might consider retaliatory measures and sell their holdings, further exerting downward pressure on prices.

The Treasury yield curve, which reflects the trading rates of Treasuries across various maturities, has adopted a distinctly inverted shape. This inversion signals the potential for an economic slowdown or even a recession, suggesting that lower rates may be on the horizon within the next 2-3 years. In the longer term, however, rates have risen, driven by expectations of higher inflationary pressures over time. Over a span of three weeks, yields along the curve experienced significant fluctuations, highlighting the volatility in Treasury prices across different maturities. Such pronounced volatility in sovereign fixed income instruments is quite unusual, raising concerns about market stability and the broader economic landscape.

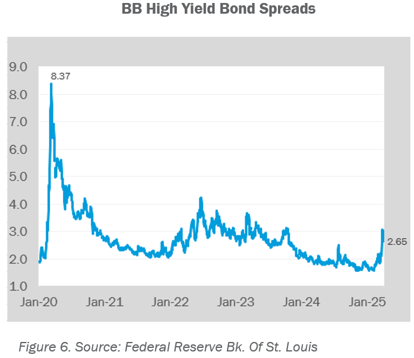

Short-term disruptions resulting from fears of an economic slowdown and structural shifts in supply chains have been reflected in declining equity markets, but they have also manifested in the widening of credit fixed income spreads during this period. Between March 24 and April 8, spreads on BB high-yield bonds expanded by 120 basis points. While currently at 300 basis points over Treasuries—considered relatively "tight"—there is a possibility that these spreads could further widen if economic conditions worsen and interest rates remain high. The prevalent "wait and see" mentality among companies and even bond traders often results in a decrease in market transactions. In such less liquid markets, bid-ask spreads tend to widen, which can further affect transaction costs and lead to increased spreads. Many bond managers are strategically poised to take advantage of opportunities to acquire securities at reduced prices during such fluctuations. However, in discussions with managers, there exists a mix of optimism and uncertainty regarding the likelihood of these opportunities materializing.

"Liberation Day"

One of President Trump's key objectives with the imposition of tariffs was to reduce the United States' dependence on potential political rivals for critical components, such as microchip fabrication, while fostering their production domestically. In the medium term, any scenario involving "reshoring" or "onshoring" must be assessed against a variety of factors, including capital and labor costs, potential technological advancements, the economic and social implications of the demand for skilled labor, and prevailing immigration policies.

The landscape of global trading relationships is intricate, shaped by a myriad of economic, political, and strategic factors. While it is inevitable that many businesses may experience disruption and displacement in the short term due to rising costs and trade restrictions, these new economic dynamics will also create fresh opportunities in the medium term. Importers are likely to explore “reshoring” options and seek partnerships with alternative trade partners, thereby unlocking potential economic opportunities for emerging markets. We believe this shift could serve as a significant catalyst for growth in non-U.S. equities over the medium term.

The value of the U.S. Dollar fluctuates against other currencies for a variety of reasons. Since the global financial crisis of 2008, a combination of robust economic growth, political stability, and the success of U.S. technology firms has bolstered the strength of the Dollar, even in the face of persistent trade deficits. Additionally, a significant factor reinforcing the Dollar’s value is its status as the primary currency for global transactions, which underpins its demand and utility in the international market.

There is an inherent cyclicality in the relative strength of currencies. Following an extended period of “U.S. exceptionalism,” a prolonged trade war and elevated tariffs may trigger shifts that weaken the support for further U.S. Dollar strength. A declining Dollar carries multiple implications. On one hand, it increases the cost of imported goods and services for U.S. consumers; on the other hand, it presents opportunities for U.S. investors. A weaker home currency can provide a favorable tailwind for non-U.S. investments, enhancing returns through currency conversion benefits.

As of mid-April 2025, it is challenging to determine whether the fluctuations experienced over the past 15 years signal the beginning of a long-term trend reversal for the U.S. Dollar or merely another short-term variation within an ongoing upward trend. Regardless of how this unfolds, it seems unlikely that the U.S. Dollar will experience another appreciation of 40% or more from its current levels.

The Price of Illiquidity

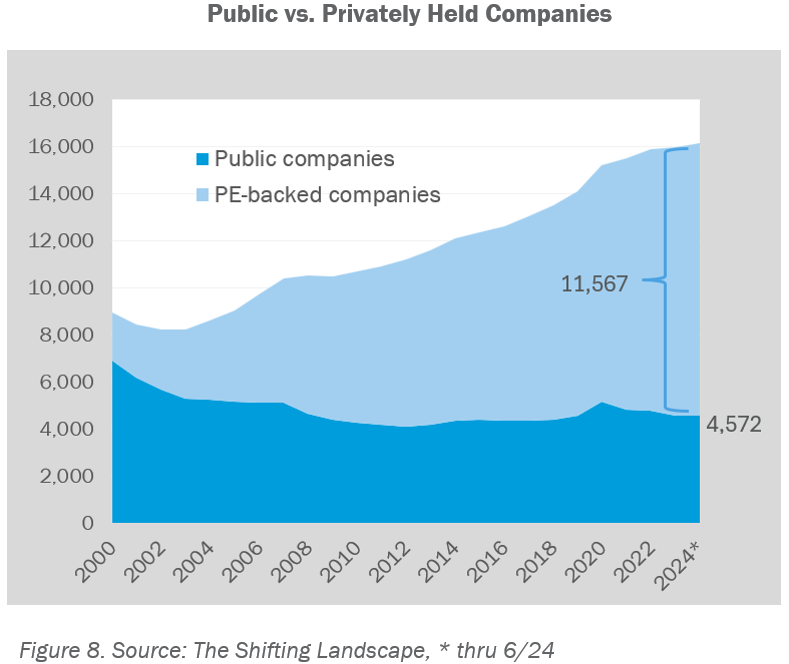

The private equity and private credit markets have expanded significantly as companies increasingly turn to private funding sources for more efficient avenues to finance growth and restructuring. Since 2000, the number of companies backed by private equity has surged fivefold, largely fueled by debt capital from private credit funds. Additionally, private investments have become a more prominent component of investment portfolios. The underlying assets are typically valued based on the transactions and valuations established during financing rounds or specific deals.

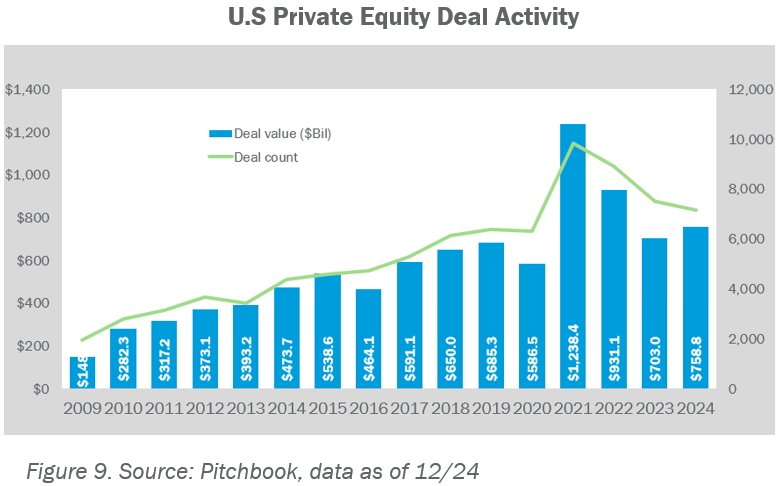

The short to medium-term effects of tariffs and trade policies introduce considerable uncertainty into the business environment for private companies. While temporary fluctuations in public equity markets typically do not impact the performance of privately held firms, over time, public market pricing can significantly influence transaction values in the private equity landscape. Potential investors may adopt more conservative valuation approaches for companies viewed as higher risk due to these policies. We have already observed a decline in deal activity since its peak in 2021. In the near term, transaction activity may stall, and a prolonged period of elevated interest rates and economic uncertainty could exert additional pressure on companies seeking exits or refinancing options.

The impact of economic changes will vary across industries within the middle market, where many privately held companies operate. Manufacturing firms that depend on imported raw materials may be particularly vulnerable to pressures on pricing and profit margins. However, proactive adaptation can help sustain valuations amid a challenging economic environment. The added economic strain of trade restrictions may also accelerate the adoption of new technologies and artificial intelligence, enhancing productivity and helping companies offset higher costs while boosting competitiveness.

Moreover, extended periods of economic uncertainty often lead private equity holders to seek exits, creating opportunities in the secondary market. It remains uncertain how the outcomes of trade negotiations will reshape political and economic relationships among countries in the long run.

Given the daily fluctuations of nearly 1,000 points in the Dow Jones Index amid significant discussions surrounding international trade policies, we can expect continued market volatility for the foreseeable future. In our view, investors with long-term capital should remain focused on upholding a strategic allocation framework that aligns with their enduring objectives. At the same time, these market conditions underscore the importance of maintaining adequate liquidity to meet short-term spending needs and capitalize on potential market dislocations.

Disclosures

Canterbury believes that the information contained herein is accurate and/or derived from sources which are reliable, but Canterbury does not warrant its accuracy or completeness. Canterbury has no obligation (express or implied) to update any or all the information contained herein or to advise you of any changes. The nature of any trade restriction or tariff, as well as its effect on economic conditions, are complex. The blog post does not aim to provide accurate or complete description of its dynamics. To the extent any information herein constitutes "forward-looking statements" (which can be identified by the use of forward-looking terminology such as "may", "will", "should", "expect", "anticipate", "upside", "potential", "project", "estimate", "intend", "continue", "target", "pending" or "believe" or comparable terminology), please note that, due to various risks and uncertainties, actual events, results or performance may differ materially from those reflected or contemplated in such forward-looking statements. Any forward-looking statements are for illustrative purposes only and are not to be relied upon as predictive of any specific economic or financial outcome. The blog is for informational purpose only and not to be construed as a recommendation to invest in any specific security or strategy. It is not to be seen as a solicitation to engage Canterbury for its consulting services.

Ms. Parekh is a shareholder of Canterbury and is an investment consultant advising clients on investment strategy, risk management and portfolio construction. She is a member of the Canterbury Outsourced CIO platform, which caters to institutions and private clients who wish to outsource day-to-day management of their portfolios to Canterbury. She is also a member of each of the firm’s five Manager Research Committees. She joined Canterbury in 1996 as the manager of analytics with responsibility for directing the firm’s account analysts and client services group. In that role, Ms. Parekh secured many of the asset allocation modeling and research software tools we use today. In 2001, she became the director of manager research, responsible for oversight of all manager, fund, and product research; maintenance of Canterbury’s proprietary research database; and chairing the Investment Manager Research Committee. Ms. Parekh graduated from the University of Hong Kong with a Bachelor of Arts in economics. She completed her Master of Business Administration at Shenandoah University.