In 2018, Canterbury formed an internal environmental, social, and governance (ESG) committee to synthesize and streamline the ever-growing ESG investment universe. The committee has since created a framework and toolkit to assist clients in finding customized ESG solutions that align with their mission, values, or investment process. Canterbury defines ESG as three separate categories: exclusionary screening, best-in-class selection, and positive impact.

In the second part of our three-part series on ESG, we will focus on best-in-class selection and how it can be implemented across client portfolios.

Best-in-class selection targets companies with the best ESG attributes or identifies corporations that have the potential to improve their ESG standing. Evaluation can occur in two ways:

Best-in-class selection integrates ESG factors into the investment process and can further enhance an investor’s values and/or the risk-adjusted returns within the portfolio. The integration process is inclusionary and focuses on quantifying the value or financial materiality of ESG characteristics. MSCI and other data platforms provide ESG metrics and analysis to assist in identifying the top performers within a given industry or sector.

By integrating ESG factors that are material, investors can choose to align their investments with their values while maintaining similar return and risk expectations to that of a traditional portfolio. At a high level, the process involves overweighting companies with favorable ESG scores while underweighting companies with unfavorable ESG scores.

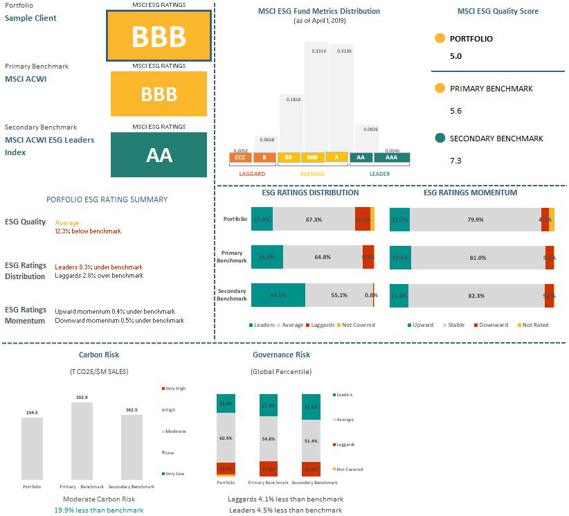

As a first step, Canterbury utilizes the MSCI ESG Ratings platform to better understand clients’ ESG risks and opportunities.

A sample of the MSCI ESG Portfolio Summary Report (Exhibit A) compares an investor’s ESG characteristics to that of a traditional and/or ESG-oriented benchmark. ESG ratings are based on letter grades, from AAA (highest rating) to CCC (lowest rating). The report displays the following characteristics of a portfolio:

Exhibit A. Source: MSCI as of April 1, 2019

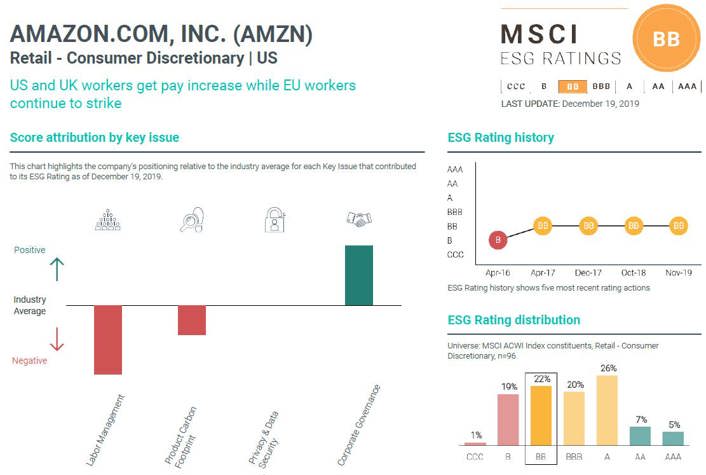

Moreover, ESG characteristics for individual companies can be analyzed relative to industry peers on a more granular level. The additional insight can help determine whether a large portfolio holding should be overweight or underweight relative to the benchmark-based ESG scoring, all else being equal. The company, Amazon, is used as an example in Exhibit B.

Exhibit B. Source: MSCI as of December 19, 2019

While MSCI has a robust methodology for ESG scoring, one must not interpret the ratings at 100% face value. Similar to credit rating agencies, ESG methodologies can differ between various data providers (i.e. MSCI, Sustainalytics, etc.), which could lead to a potentially wide range of rating outputs. However, by choosing an ESG Ratings platform and sticking with the methodology, a consultant and client can begin the discussion on the process of how to best implement a Best-In-Class selection or ESG integration program.

Best-In-Class selection can be implemented through either an active or a passive approach.

Active managers aim to identify financial materiality by integrating ESG research into the investment process. Portfolio managers invest in companies that exhibit the relevant ESG factors that will reduce long-term risks and generate sustainable alpha. While these types of strategies may exhibit positive ESG characteristics, the primary objective is to produce strong risk-adjusted returns. Global equity mandates with an emphasis on ESG integration are popular in Europe and have started to gain momentum in North America.

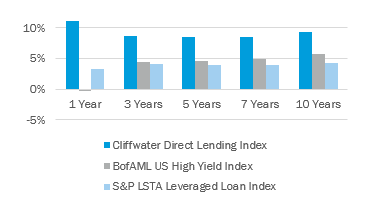

Investors can also passively invest in ESG-integrated indices, such as MSCI ACWI ESG Leaders. These types of indices tend to have static methodologies that overweight and underweight traditional index constituents based on their underlying ESG ratings. While performance can vary depending on different periods, the MSCI ACWI ESG Leaders Index has outperformed the traditional MSCI ACWI on a risk-adjusted basis over the last 10 years:

Exhibit C. Source: Morningstar as of December 31, 2019

Lastly, investors can implement a values-based approach to their passively-managed exposure by optimizing portfolio construction based on tracking error (i.e. the difference in portfolio returns relative to the difference in benchmark returns). Investment managers can overweight, underweight, or exclude companies based on a client’s ESG preferences while minimizing the difference in return between the portfolio and the relevant benchmark. The higher the tracking error budget, the more flexibility a client has to express their values within the portfolio.

![]()

As described above and in Understanding ESG Part I: Exclusionary Screening, investors can incorporate their values through either an exclusionary or inclusionary approach. Taken one step further, better risk-adjusted performance may be achieved by integrating ESG factors into the investment process. In the final installment of our ESG Series, we will explore the role of impact investing from an individual and institutional investor’s perspective.