The equity markets have entered a downturn due to the COVID-19 situation, with the S&P 500 down 31.9% from its peak as of market close on March 20, 2020. How should investors think about allocating to private equity at this time? Furthermore, how have the private markets fared during past downturns? This blog seeks to provide an answer to those questions.

Canterbury utilized data of the most recent reporting quarter with internal rate of return (IRR) as of March 17, 2020 from PitchBook for this analysis. All private equity is inclusive of buyout, fund of funds, growth, venture, and secondaries funds. The total data set is 1,461 funds with vintage years between 1995 and 2012.

Dot-Com Bubble

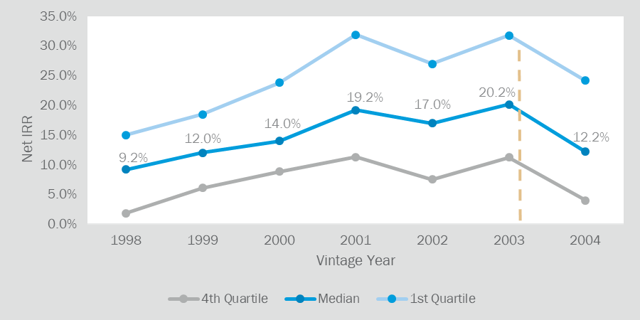

The S&P 500 peaked in March 2000 in a two-year downturn that did not reach its trough until September 2002. As shown in Exhibit A, performance was stronger in all three of those vintage years than in the three years prior. The performance of venture capital had a substantial impact on muted performance with the median venture fund in 2001, 2002, and 2003 all failing to return total capital deployed.

All Private Equity — Dot-Com

Exhibit A

The data shows the same trend for buyout (Exhibit B), where the median fund raised between 2001 and 2003 outperformed those raised between 1998 and 2000 by an average of 7.1%. Notably, these were the three strongest median net IRR performers of all vintage years in the sample.

Buyout — Dot-Com

Exhibit B

Global Financial Crisis (GFC)

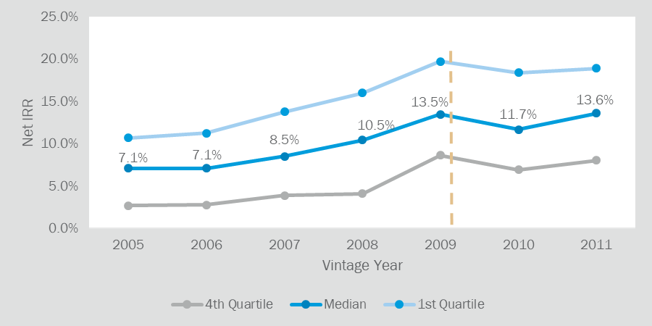

The GFC was a steeper downturn than the dot-com bubble but also a faster recovery with a drop that began in May 2008 and troughed less than a year later in March 2009. Performance by vintage year leading up to and during the GFC followed the same trend as the prior downturn. In this case (Exhibit C), the net IRR’s were slightly higher as the bull market ultimately lasted more than a decade, meaning that funds raised in 2008 and 2009 were — in many cases — able to invest, harvest, and liquidate without facing adverse market conditions.

All Private Equity — GFC

Exhibit C

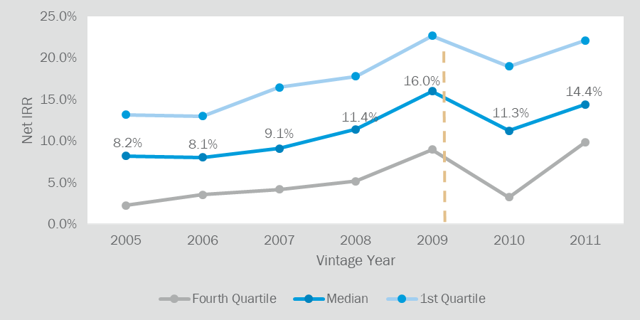

Buyout was again the same story, with 2009 representing the strongest vintage year since 2003 during the previous downturn (Exhibit D). During this time, investors were hesitant to commit to funds given the uncertainty in the market, resulting in just $246 billion raised in private equity that year relative to $636 billion the year before, a 62% decrease according to Preqin’s “Private Equity Fundraising in 2009.”

Buyout — GFC

Exhibit D

During the past two downturns, funds raised in the years prior to the downturn itself were heavily affected. This is due to several reasons that include the following:

Meanwhile, the funds raised during the downturns experienced more success. In both cases, this was largely attributable to a lower valuation environment and the prevalence of forced sellers, enabling firms to purchase assets at more attractive valuations than they could have just a few years prior. Investors that chose to take their foot off the gas pedal in 2001 through 2003 or in 2008 and 2009 have substantially underperformed those that continued to deploy consistently.

In conclusion, the data indicates that investors that did not have liquidity concerns were better served continuing to commit capital to private equity funds during downturns, as some of the most meaningful returns came from funds raised during those vintage years. While the future cannot be guaranteed, it is likely that history will repeat itself and markets will rebound, with investors rewarded for staying the course in this situation as well.