Environmental, social, and governance (ESG) criteria have become a top priority for many investors and portfolio managers when it comes to investment decision-making. ESG strategies, also known as sustainable funds, accounted for nearly one-fourth of overall flows into open-end funds and ETFs in the United States last year.1 This blog examines the record-breaking demand for and launch of sustainable funds in 2020, sustainable fund performance, and the future of sustainable investing.

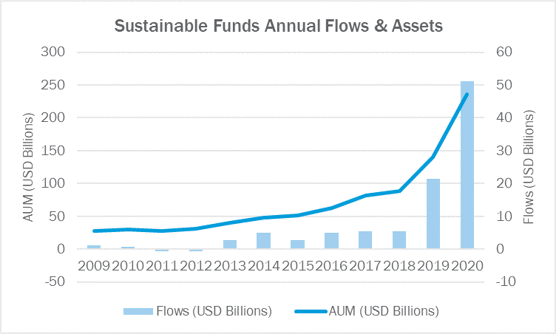

In 2020, funds linked to ESG principles took in nearly $51.1 billion, far surpassing the previous $21.4 billion record set in 2019.

Exhibit A. Source: Morningstar as of December 31, 2020.

The global pandemic, policymakers, the social justice movements in the U.S., and the U.S. presidential election emphasized the importance of and helped drive the demand for investing with an ESG framework in mind. Leaders across the world pledged their commitment to sustainability. In the U.S., President Joe Biden promised to invest trillions in decarbonizing the U.S. economy and rejoined the Paris Climate Agreement. President Xi Jinping addressed the United Nations with plans to achieve carbon neutrality before 2060. In Europe, policy initiatives and sustainability goals appear the most ambitious. The European Green Deal aims to transform Europe into the first climate-neutral continent by 2050. The European commission president Ursula von der Leyen has called it “Europe’s man on the moon moment.”2

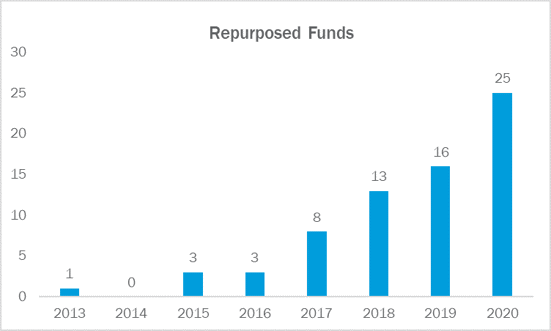

Many investors and countries have committed to this new sustainability framework, and so too have fund managers. In their article on ESG funds, Morningstar noted that last year, managers launched a record-breaking 71 sustainable funds and repurposed 25 existing funds as “sustainable funds.” For active managers, performance challenges and a move to passive investing have created significant headwinds. In 2020 alone, investors pulled $289 billion out of open-end funds whereas sustainable open-end funds added $17.4 billion.

Exhibit B. Source: : Morningstar as of December 31, 2020.

Commitment to ESG is more than just a short-term trend in the investment industry. In a recent study of 40 asset managers spread across the globe, virtually all have incorporated ESG to some degree or have plans to do so across their investment strategies.1 For instance, Invesco, which manages $1.37 trillion, has targeted full ESG integration by 2023.3

In the past, investors questioned whether investing in strategies with strong ESG practices would compromise returns. Sustainable managers have shown that is not necessarily the case. In the five years ending December 31, 2020, 69% of sustainable funds ranked in the top half of their asset class category, according to data from Morningstar.1 Last year was a particularly impressive year for sustainable equity managers. According to Morningstar, three of every four sustainable equity funds finished in the top half of their Morningstar category and 43% posted top-quartile returns. Only 6% landed in their category’s bottom quartile. Of note, there was lackluster performance in the energy sector and a strong outperformance of growth, which may have contributed to ESG funds generally performing better than their peers.

Today, investors see not only the environmental and social value, but also the economic value of investing in companies with a strong ESG framework. In a survey based on interviews with 80 mid-sized U.S. institutional investors, a majority of institutions consider ESG as a means to enhance returns and reduce risk.4

The heightened focus on the social and environmental impact of corporations has driven ESG to the forefront. Companies understand the importance of a robust ESG program to attract capital, build a strong corporate brand, and promote long-term sustainable growth.

As more strategies in the sustainable space build competitive performance track records, previous doubts of underperformance have diminished. This is particularly important for advisors and consultants who seek strong performing investment options in the ESG space. Beyond performance, sustainable fund managers also promote their stewardship activities and their impact investing to shareholders. Over time, as a company’s investor base becomes more ESG-centric, management teams can focus on the long-term perspective of the business and what is best for not only its shareholders, but for society and the planet.

At Canterbury Consulting, we recognize the importance of sustainable investing. As signatories of the United Nation’s Principles for Responsible Investment, we too focus on the implications of sustainability for investors and consider these issues in our investment decision-making practices.

Sources:

1 The Morningstar ESG Commitment Level (Morningstar, Nov. 17, 2020.)

2 Harvey, Fiona & Rankin, Jennifer. What is the European Green Deal and will it really cost €1tn? (The Guardian, March 9, 2020.)

3 2019 Invesco Climate Change Report: In line with the Task Force on Climate-related Financial Disclosures (TCFD). (Invesco, 2019.)

4 Fu, Lisa. Inst'l Investors Show Appetite for Investment-Grade ESG Strategies? (FundFire, March 10, 2021.)