General Partner (“GP”)-led secondaries in private markets have exploded in popularity over the past few years on the basis of both deal count and aggregate deal volume. This blog post discusses the increase in volume, how continuation funds are typically structured, and commentary on the positive and negative attributes for limited partners.

What is a Continuation Fund?

While there are several types of GP-led secondary transactions, this blog post will focus on the most prevalent, which is the continuation fund (84% of GP-led transactions in 2021[1]). A continuation fund involves the creation of a new vehicle that acquires some or all of the remaining unrealized assets from the original fund. General Partners typically utilize continuation funds when they feel there is still significant value to be derived from existing positions in the portfolio that will require a longer time horizon than what is left in the fund’s life.

When a continuation fund is formed, limited partners are given the option to either a) liquidate their position at a third-party calculated valuation or b) roll some or all of their position into the new vehicle, which typically involves new terms related to fund life, management fees, expenses, and carried interest. For the purpose of alignment, the General Partner will generally roll their full stake into the new vehicle.

Growth of a GP-led Secondary Market

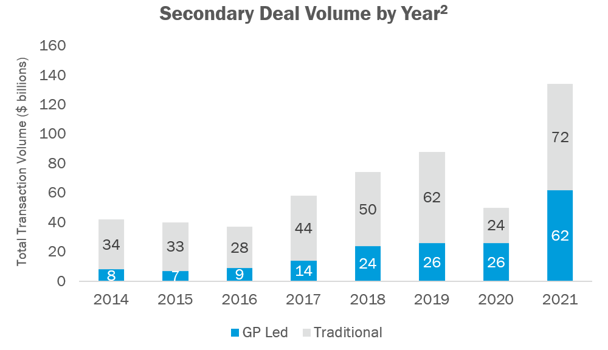

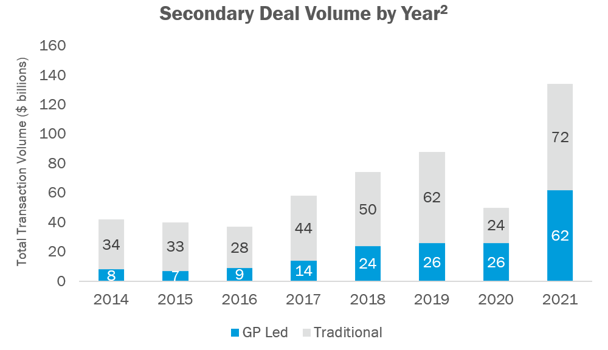

While GP-led secondary transactions have been taking place for decades, it was historically a niche strategy and did not comprise a significant percentage of overall secondary volume until the last decade. As depicted by the graph below, in just five years, total global transaction volume for GP-led secondaries went from $9 billion to $62 billion, an increase of 5.89x.

In the four years ended 2021, GP-led secondaries have averaged 40% of the overall market, compared to an average of 21% in the prior four years. This percent increase has occurred despite consistent growth on the traditional side.

What are the benefits of Continuation Funds?

The primary benefit of a continuation fund is to allow a General Partner, as well as their investors, an opportunity to realize potential additional investment gains from a company that would otherwise need to be sold due to the end of a fund’s life. Fund managers have consistently lamented spending significant resources and capital to position a company for future growth only to sell it to a financial or strategic buyer that gets to enjoy the future compounding returns. The following are some of the key benefits around continuation funds:

- Mismatched Fund and Company Timeline: Continuation fund transactions allow the manager to raise and deploy additional capital to companies well after the termination of their investment period, which can be beneficial for value creation and continued growth. This may be particularly beneficial with high cash flowing companies that can compound over many years.

- Alignment: In most cases, the General Partner will roll their entire commitment and unrealized carried interest from a company into the continuation vehicle, which creates significant alignment between the GP and LP’s. In general, Canterbury does not support continuation funds where this is not the case due to a misalignment of incentives.

- Limited Partner Consent: Most continuation funds require consent from limited partners (typically a majority in interest) in order for the transaction to consummate. As a result, if the limited partners in a fund do not believe that the transaction is in their best interest, they can deny it from taking place. With that said, as with all consent request, the largest investors have an outsized impact on these decisions.

Concerns About Continuation Funds

In recent years, some limited partners have expressed displeasure or even concern with the prevalence of GP-led secondaries and continuation vehicles from funds that they invest with. The following are some of the key concerns around these transactions:

- Valuation: While the portfolio companies involved in the transaction are valued by an independent third party, private equity companies are frequently exited at a higher valuation than their most recent quarterly mark. Therefore, while the valuation is “fair”, it is likely that in many cases, the GP would be able to sell the company for a higher price if they ran a full sales process.

- Scope of Investment: “Limited Partner” is defined as a partner who has no management authority and whose liability is restricted to the amount of their investment. Limited partners are then paying a management fee, organizational expenses, and carried interest to the General Partner in order for them to manage all aspects of the fund and the portfolio. When a continuation fund vehicle is proposed, investors are required to opine by a) approving the transaction and b) deciding whether to participate, both of which some feel are outside the scope of a limited partner.

- Underwriting Capabilities: With single asset transactions (and even concentrated multi-asset transactions), limited partners are essentially required to underwrite a direct investment when determining whether to participate. Many investors are staffed to underwrite private equity funds but not direct deals, as the skillset and resource requirement to do so are different.

- Fees: GP-led secondary transactions involve a material amount of transaction fees and expenses in addition to a management fee, expenses, and carried interest during the life of the continuation vehicle. This includes transaction costs (success fees to transaction advisor), cost of structuring the vehicle, legal costs, representation and warranty insurance, and any internal costs from investors for analysis, legal reviews, and document completion, among others. Investors should be very clear on all fees prior to participating in a continuation vehicle.

- Transaction Lag: In many cases, a secondary process to solicit interested buyers is run and negotiated over a period of several months. Thus by the time a transaction takes place, the reference date valuation may be more than six months old, and the company’s financial performance could have meaningfully changed. If the performance has improved, then limited partners are much more inclined to participate as they do not want to leave performance on the table. However, Canterbury has experienced multiple situations where the buyer ultimately backs out of the transaction due to weaker than expected company performance.

Sources

- Source: Pitchbook, “Continuation funds drive GP-led secondaries wave”, published February 1, 2022

- Source: 2021 Greenhill Global Secondary Market Review, January 2022